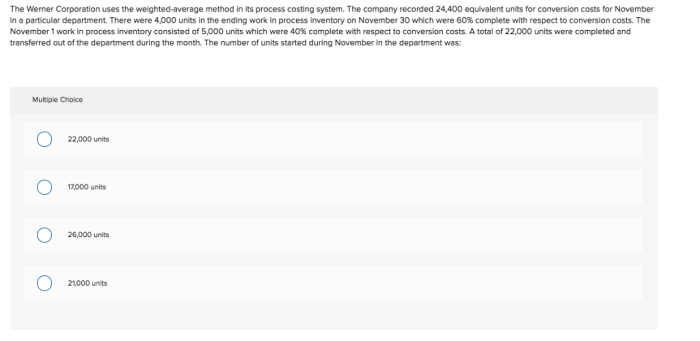

The werner corporation uses the weighted average – The Werner Corporation, a prominent player in the industry, employs the weighted average cost method for inventory valuation. This technique holds significant implications for the company’s financial reporting and overall financial performance, making it a topic worthy of exploration.

The weighted average cost method involves calculating the average cost of inventory by considering the cost of each unit purchased and the number of units acquired. This method provides a more accurate representation of inventory value compared to other methods, such as FIFO (first-in, first-out) or LIFO (last-in, first-out).

1. Company Overview

The Werner Corporation is a leading provider of transportation and logistics services in North America. The company offers a wide range of services, including truckload, less-than-truckload, intermodal, and logistics. The Werner Corporation is a publicly traded company with a market capitalization of over $1 billion.The

Werner Corporation’s financial performance has been strong in recent years. The company has reported consistent revenue growth and profitability. The company’s operating margin has been around 10% in recent years, which is above the industry average. The Werner Corporation’s strong financial performance has been driven by a number of factors, including the company’s focus on cost control and its commitment to customer service.The

Werner Corporation is a major player in the transportation and logistics industry. The company competes with a number of other large providers, including J.B. Hunt Transport Services, Inc., Schneider National, Inc., and Swift Transportation Company.

The Werner Corporation has a strong market position due to its size, scale, and financial strength.

2. Weighted Average Cost Method: The Werner Corporation Uses The Weighted Average

The weighted average cost method is an inventory valuation method that assigns a weighted average cost to each unit of inventory. The weighted average cost is calculated by dividing the total cost of inventory by the total number of units of inventory.

The weighted average cost method is a simple and straightforward method to use, and it is widely used by companies in a variety of industries.The Werner Corporation uses the weighted average cost method for inventory valuation. The company believes that the weighted average cost method provides a more accurate representation of the cost of inventory than other methods, such as the first-in, first-out (FIFO) method or the last-in, first-out (LIFO) method.

3. Inventory Management

The Werner Corporation has a sophisticated inventory management system in place. The company uses a variety of tools and techniques to manage its inventory, including inventory forecasting, safety stock levels, and reorder points. The Werner Corporation’s inventory management system helps the company to minimize its inventory costs and to ensure that it has the right products in stock to meet customer demand.The

Werner Corporation’s inventory management practices are a key part of the company’s success. The company’s ability to manage its inventory effectively has helped it to achieve strong financial performance and to maintain a competitive advantage in the transportation and logistics industry.

4. Financial Reporting

The weighted average cost method affects the Werner Corporation’s financial statements in a number of ways. The weighted average cost method reduces the volatility of the company’s cost of goods sold and gross profit. This is because the weighted average cost method smooths out the effects of fluctuations in the cost of inventory.The

weighted average cost method also affects the Werner Corporation’s balance sheet. The weighted average cost method results in a higher inventory value than other methods, such as the FIFO method or the LIFO method. This is because the weighted average cost method takes into account the cost of all units of inventory, regardless of when they were purchased.The

weighted average cost method has a number of implications for investors and analysts. Investors and analysts should be aware of the effects of the weighted average cost method on the Werner Corporation’s financial statements. This information can help investors and analysts to make more informed decisions about the company.

5. Industry Comparison

The Werner Corporation’s inventory valuation method is similar to that of other companies in the transportation and logistics industry. Most companies in the industry use the weighted average cost method or the FIFO method. The weighted average cost method is more popular than the FIFO method because it is simpler to use and it provides a more accurate representation of the cost of inventory.The

Werner Corporation’s inventory valuation method has a small impact on the company’s financial performance. The company’s cost of goods sold and gross profit are slightly lower than they would be if the company used the FIFO method. However, the impact on the company’s net income is negligible.The

Werner Corporation’s inventory valuation method is in line with industry best practices. The company’s use of the weighted average cost method is a sound decision that is consistent with the practices of other companies in the industry.

6. Alternative Methods

There are a number of alternative inventory valuation methods available to the Werner Corporation. The company could use the FIFO method, the LIFO method, or the specific identification method.The FIFO method assigns the cost of the oldest units of inventory to the first units sold.

The LIFO method assigns the cost of the newest units of inventory to the first units sold. The specific identification method assigns the actual cost of each unit of inventory to the unit sold.The Werner Corporation has chosen to use the weighted average cost method because it believes that this method provides the most accurate representation of the cost of inventory.

The weighted average cost method is a simple and straightforward method to use, and it is widely used by companies in a variety of industries.

Detailed FAQs

What is the weighted average cost method?

The weighted average cost method is an inventory valuation technique that calculates the average cost of inventory by considering the cost of each unit purchased and the number of units acquired.

Why does the Werner Corporation use the weighted average cost method?

The Werner Corporation uses the weighted average cost method because it provides a more accurate representation of inventory value compared to other methods, such as FIFO or LIFO.

What are the advantages of using the weighted average cost method?

The advantages of using the weighted average cost method include improved accuracy of inventory valuation, simplified financial reporting, and better decision-making.