Prepare the following adjusting entries at August 31 for Walgreens: A Comprehensive Guide delves into the intricacies of adjusting entries, providing a detailed roadmap for accountants and finance professionals to ensure accurate financial reporting. This guide offers a thorough understanding of the concepts, calculations, and impact of adjusting entries on the financial statements, empowering readers to confidently navigate the complexities of accounting.

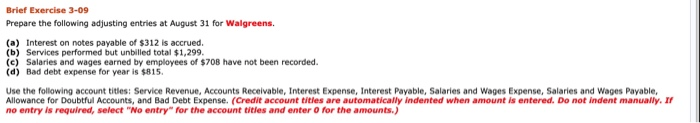

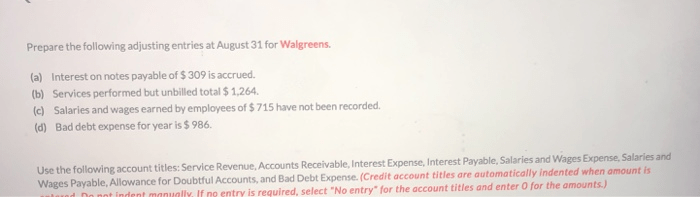

Accrued Expenses

Accrued expenses are expenses that have been incurred but not yet paid. An example of an accrued expense is salaries expense. Salaries expense is incurred when employees work, even if the employees have not yet been paid.

Adjusting Entry for Accrued Salaries Expense

The adjusting entry to accrue the salaries expense for the period ending August 31 is as follows:

Debit:Salaries Expense $X

Credit:Salaries Payable $X

The amount of the accrued expense is the amount of salaries that have been earned but not yet paid. This amount can be calculated by multiplying the number of hours worked by the hourly wage rate.

The impact of this adjustment on the income statement is to increase the expenses for the period. The impact on the balance sheet is to increase the liabilities.

Deferred Revenue

Deferred revenue is revenue that has been received but not yet earned. An example of deferred revenue is rent received in advance. Rent received in advance is revenue that has been received for a period of time that has not yet expired.

Adjusting Entry for Deferred Revenue

The adjusting entry to defer a portion of the revenue earned in August but not yet recognized is as follows:

Debit:Unearned Revenue $X

Credit:Revenue $X

The amount of revenue to be deferred is the amount of revenue that has been received but not yet earned. This amount can be calculated by multiplying the number of months of rent that have not yet expired by the monthly rent amount.

The impact of this adjustment on the income statement is to decrease the revenue for the period. The impact on the balance sheet is to increase the liabilities.

Depreciation Expense

Depreciation expense is the expense that is recognized when an asset is used over time. An example of depreciation expense is depreciation expense on property and equipment.

Adjusting Entry for Depreciation Expense

The adjusting entry to record the depreciation expense on Walgreens’ property and equipment for August is as follows:

Debit:Depreciation Expense $X

Credit:Accumulated Depreciation $X

The amount of depreciation expense can be calculated by multiplying the depreciable base of the asset by the depreciation rate.

The impact of this adjustment on the income statement is to increase the expenses for the period. The impact on the balance sheet is to decrease the asset and increase the accumulated depreciation.

Bad Debt Expense

Bad debt expense is the expense that is recognized when a customer fails to pay for goods or services that have been sold to them. An example of bad debt expense is bad debt expense on accounts receivable.

Adjusting Entry for Bad Debt Expense

The adjusting entry to estimate and record the bad debt expense for August is as follows:

Debit:Bad Debt Expense $X

Credit:Allowance for Bad Debts $X

The amount of bad debt expense can be estimated by multiplying the total accounts receivable by the bad debt percentage.

The impact of this adjustment on the income statement is to increase the expenses for the period. The impact on the balance sheet is to decrease the accounts receivable and increase the allowance for bad debts.

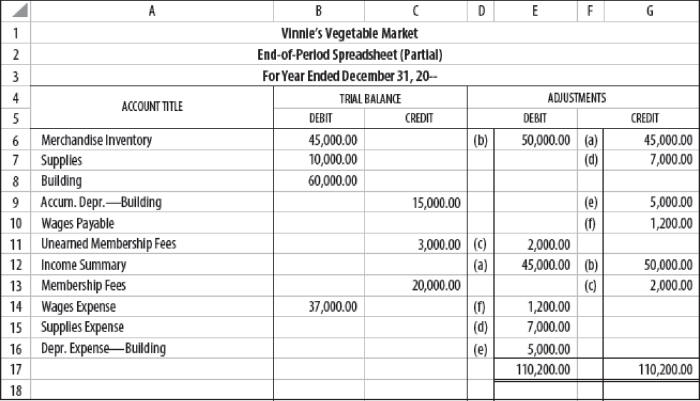

Inventory Adjustment

An inventory adjustment is an adjustment that is made to the inventory records to reconcile the physical inventory count with the inventory records.

Steps for Performing an Inventory Adjustment

- Count the physical inventory.

- Compare the physical inventory count to the inventory records.

- If there is a difference between the physical inventory count and the inventory records, make an adjusting entry to correct the inventory records.

Adjusting Entry for Inventory Adjustment

The adjusting entry for inventory adjustment is as follows:

Debit:Inventory $X

Credit:Inventory Adjustment $X

The amount of the inventory adjustment is the difference between the physical inventory count and the inventory records.

The impact of this adjustment on the income statement is to increase or decrease the cost of goods sold. The impact on the balance sheet is to increase or decrease the inventory.

Prepaid Expenses

Prepaid expenses are expenses that have been paid but not yet used. An example of prepaid expenses is prepaid insurance.

Adjusting Entry for Prepaid Expenses, Prepare the following adjusting entries at august 31 for walgreens

The adjusting entry to recognize the portion of prepaid expenses used during August is as follows:

Debit:Insurance Expense $X

Credit:Prepaid Insurance $X

The amount of prepaid expenses to be recognized is the amount of prepaid expenses that have expired during the period.

The impact of this adjustment on the income statement is to increase the expenses for the period. The impact on the balance sheet is to decrease the prepaid expenses.

Unearned Revenue

Unearned revenue is revenue that has been received but not yet earned. An example of unearned revenue is rent received in advance.

Adjusting Entry for Unearned Revenue

The adjusting entry to defer a portion of the revenue received in August but not yet earned is as follows:

Debit:Unearned Revenue $X

Credit:Revenue $X

The amount of revenue to be deferred is the amount of revenue that has been received but not yet earned. This amount can be calculated by multiplying the number of months of rent that have not yet expired by the monthly rent amount.

The impact of this adjustment on the income statement is to decrease the revenue for the period. The impact on the balance sheet is to increase the liabilities.

Question Bank: Prepare The Following Adjusting Entries At August 31 For Walgreens

What is the purpose of an adjusting entry?

Adjusting entries are used to update the financial records to reflect events that have occurred but have not yet been recorded. This ensures that the financial statements are accurate and up-to-date.

When should adjusting entries be made?

Adjusting entries should be made at the end of each accounting period, typically monthly or annually.

What are the different types of adjusting entries?

There are several types of adjusting entries, including accruals, deferrals, depreciation, bad debt expense, inventory adjustment, prepaid expenses, and unearned revenue.