Faked numbers in tax returns invoices – Faked numbers in tax returns and invoices, a pervasive issue that undermines the integrity of the tax system, warrants meticulous analysis. This comprehensive discourse delves into the nefarious methods employed to falsify financial information, exposing the severe legal and financial repercussions for individuals, businesses, and the government.

By shedding light on the techniques used to detect and prevent such fraudulent practices, we aim to safeguard the tax system’s credibility and promote transparency in financial reporting.

The ensuing paragraphs will provide a detailed examination of the methods used to fake numbers, the consequences of such actions, and the measures implemented to detect and prevent these malpractices. Real-world case studies will illustrate the tangible effects of falsifying financial information, while an exploration of the legal and regulatory framework will highlight areas for potential improvement.

Finally, we will conclude with a discussion of best practices and future trends in the detection and prevention of faked numbers in tax returns and invoices.

Faked Numbers in Tax Returns and Invoices: Faked Numbers In Tax Returns Invoices

Faked numbers in tax returns and invoices constitute a serious offense, jeopardizing the integrity of the tax system and financial reporting practices. This analysis aims to shed light on the methods employed to falsify numbers, their consequences, and strategies for detection and prevention.

Methods of Faking Numbers, Faked numbers in tax returns invoices

- Inflating expenses:Exaggerating business expenses to reduce taxable income.

- Understating income:Concealing or omitting income sources to avoid paying taxes.

- Creating fictitious transactions:Fabricating invoices or receipts to support fraudulent claims.

- Altering financial records:Modifying accounting entries to manipulate financial statements.

Consequences of Faked Numbers

Faking numbers in tax returns and invoices carries severe legal and financial repercussions:

- Criminal charges:Fraudulent reporting can lead to criminal prosecution and imprisonment.

- Civil penalties:Tax authorities can impose substantial fines and interest charges.

- Reputational damage:Dishonest practices erode trust and damage the reputation of individuals and businesses.

- Economic impact:Falsified numbers distort economic data, undermining sound policymaking.

Detection and Prevention

Detecting and preventing faked numbers require vigilance and robust mechanisms:

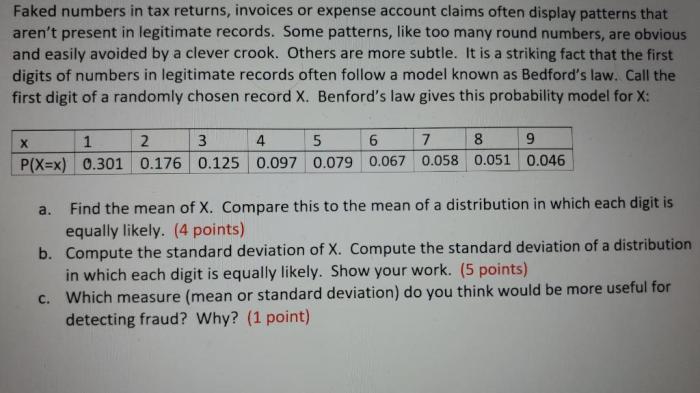

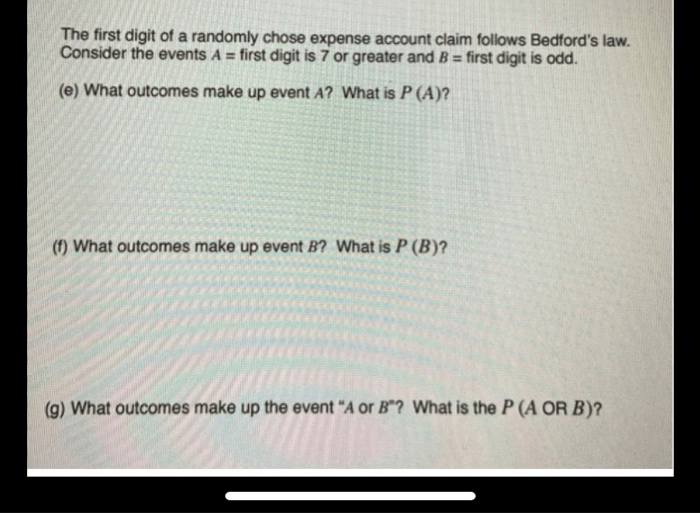

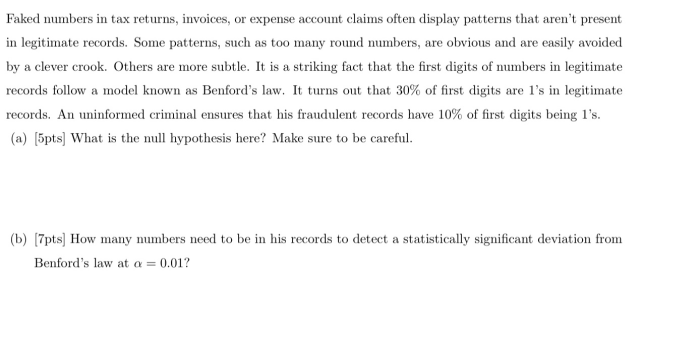

- Data analytics:Analyzing tax returns and invoices for anomalies and inconsistencies.

- Audits:Conducting thorough audits to verify the accuracy of financial records.

- Whistleblower programs:Encouraging individuals to report suspected fraud.

- Ethical guidelines:Establishing clear ethical standards for financial reporting.

Question Bank

What are the common methods used to fake numbers in tax returns and invoices?

Common methods include overstating expenses, understating income, creating fictitious transactions, and using shell companies to hide illicit activities.

What are the legal consequences of falsifying numbers in tax returns and invoices?

Legal consequences can include criminal charges, fines, imprisonment, and asset forfeiture.

What measures can be taken to prevent faked numbers in tax returns and invoices?

Preventive measures include加强审计程序, implementing data analytics tools, and promoting ethical reporting practices.